- 12018年出生率 京沪津普降 东北垫底_2018年上海孩子出生率

- 2不同版本CUDA和cudnn下载安装并配置环境变量_cuda下载按照

- 3Pygame编程(3)draw模块_pygame中draw

- 4QT 实现放大镜跟随鼠标效果

- 5求职数据分析,项目经验该怎么写

- 62023年十四届蓝桥杯省赛大学B组真题(Java完整版)_说明 给你一个无向图,这个无向图有 n 如果你要连接 x,y,那么需要花费 ax+ay 的成

- 7jenkins部署后的操作将jar传入目标服务器并且运行jar包_jenkins 将jar发送到另一台机器

- 8python 科学计数法_Python编程基础篇>04格式化输出转义及input输入

- 9Flutter和Rust如何优雅的交互_flutter rust

- 10c#游戏辅助脚本教程——变量

signature=269dd4cc090d993c7b636ef41501ba35,gfapr4q18_6k.htm - Generated by SEC Publisher for SEC Fil...

赞

踩

0001292814-19-000947.txt : 20190329

0001292814-19-000947.hdr.sgml : 20190329

20190328190010

ACCESSION NUMBER:0001292814-19-000947

CONFORMED SUBMISSION TYPE:6-K

PUBLIC DOCUMENT COUNT:11

CONFORMED PERIOD OF REPORT:20190331

FILED AS OF DATE:20190329

DATE AS OF CHANGE:20190328

FILER:

COMPANY DATA:

COMPANY CONFORMED NAME:Gafisa S.A.

CENTRAL INDEX KEY:0001389207

STANDARD INDUSTRIAL CLASSIFICATION:GEN BUILDING CONTRACTORS - RESIDENTIAL BUILDINGS [1520]

IRS NUMBER:000000000

FISCAL YEAR END:1231

FILING VALUES:

FORM TYPE:6-K

SEC ACT:1934 Act

SEC FILE NUMBER:001-33356

FILM NUMBER:19713409

BUSINESS ADDRESS:

STREET 1:AV. NACOES UNIDAS, 8501 - 19 ANDAR

STREET 2:05477-000 - ALTO DE PINHEIROS

CITY:SAO PAULO - SP

STATE:D5

ZIP:00000

BUSINESS PHONE:551130259000

MAIL ADDRESS:

STREET 1:AV. NACOES UNIDAS, 8501 - 19 ANDAR

STREET 2:05477-000 - ALTO DE PINHEIROS

CITY:SAO PAULO - SP

STATE:D5

ZIP:00000

6-K

1

gfapr4q18_6k.htm

FORM 6-K

gfapr4q18_6k.htm - Generated by SEC Publisher for SEC Filing

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

FOR IMMEDIATE RELEASE- São Paulo, March 28, 2019 – Gafisa S.A. (B3: GFSA3; OTC: GFASY),one of Brazil’sleading homebuilders, today reported its financial results for the fourth quarter ended December31, 2018.

GAFISA ANNOUNCES4Q18 and 2018 RESULTS

During 2018, the Company underwent a restructuring process. The R$250.8 million capital increase was concluded in February, lessening immediate cash pressure. In September, a change in the Company’s management led to the establishment of a new turnaround strategy in the last quarter, which focused on structure and cost adjustment including the shutdown of a branch in Rio de Janeiro; the relocation of our headquarters; and the revision of our processes.

This new turnaround strategy should save approximately R$110 million p.a. by reducing (i) headcount by 50%, accounting for savings of R$45 million/year; (ii) marketing by R$40 million/year; (iii) IT by R$18 million/year; (iv) sales stand expenditure by R$4 million; and saving (v) R$4 million/year with the relocation of our headquarters. Part of these gains already materialized in Nov/18 and Dec/18 but will become more evident in upcoming quarters.

Adjustment needs mapped out during 4Q18, such as impairment of land/inventories, the goodwill impairment test to remeasure the 30% stake in Alphaville and reversal/entry of provision, amongst others, were recorded in 4Q18, adversely affecting results by R$276 million.

Thus, Gafisa starts 2019 well-positioned for the new cycle in the real estate sector, equipped with quality assets and a renowned brand. Our pipeline launches rely on profitable residential projects that are fine-tuned to the market demand and located in the City of São Paulo. In this way, a higher volume of launches are scheduled for the second half of 2019.

Inventory PSV totals R$1.2 billion, with higher market liquidity (73% of total inventory PSV) concentrated in São Paulo residential units.

Dissolutions, which for several years caused an imbalance in various projects, significantly decreased in 2018. The monthly average volume of dissolutions declined from R$34 million in 2017 to R$19 million in 2018. This downward trend should continue in 2019, with the approval of a law that regulates dissolutions. Pursuant to new legislation, developers may retain up to 50% of the amount paid by the consumer in cases where the purchase has been waived, conferring greater legal safety to the sector.

Net debt totaled R$752 million in Dec/18, down 21% from the previous year. Leverage, measured by net debt/shareholders’ equity ratio, jumped to 153% at the end of 2018, mainly impacted by negative results in the period and impairments recorded. Excluding project financing, the net debt/shareholders’ equity ratio was 45%. Funding alternatives are being analyzed to remodel the Company’s ownership structure.

Our expectations for 2019 are positive, the macroeconomic scenario is improving, and the market has begun to show signs of recovery. The growth upturn will occur gradually and sustainably, aiming for a solid performance that will create value for shareholders and stakeholders.

Roberto Luz Portella

CEO, CFO, and Investor Relations Officer

1

MAIN CONSOLIDATED INDICATORS

Table 1 - Operational Performance (R$ 000)

4Q18

3Q18

Q/Q (%)

4Q17

Y/Y (%)

12M18

12M17

Y/Y (%)

Launches

118,936

71,144

67.2%

90,113

32.0%

728,670

553,954

31.5%

Gross Sales

153,406

188,125

-18.5%

216,988

-29.3%

1,040,848

1,131,823

-8.0%

Cancellations

(58,401)

(51,661)

13.0%

(95,407)

-38.8%

(227,677)

(411,658)

-44.7%

Net Pre-Sales

95,005

136,464

-30.4%

121,851

-22.0%

813,172

720,164

12.9%

Speed of Sales (SoS)

7.20%

9.40%

-2.2 p,p,

7.40%

-0.2 p,p,

39.90%

32.00%

7.9 p,p,

Delivered PSV

263,254

346,009

-23.9%

41,171

539.4%

910,255

861,325

5.7%

Inventories

1,225,066

1,318,698

-7.1%

1,581,402

-22.5%

1,225,066

1,581,402

-22.5%

Table 2 – Financial Performance (R$ 000)

4Q18

3Q18

Q/Q (%)

4Q17

Y/Y (%)

12M18

12M176

Y/Y (%)

Net Revenue

192,917

252,306

-24%

342,057

-44%

960,891

786,174

22%

Recurring Adjusted Gross Profit¹

46,942

80,330

-42%

91,620

-49%

290,771

143,535

103%

Recurring Adjusted Gross Margin

24.3%

31.8%

-751 bps

26.8%

-245 bps

30.3%

18.3%

1,200 bps

Recurring Adjusted EBITDA²

29,247

37,776

-23%

44,324

-34%

126,954

(50,828)

-350%

Recurring Adjusted EBITDA Margin

15.2%

15.0%

19 bps

13.0%

220 bps

13.2%

-6.5%

1,968 bps

Recurring Adjusted Net Income

11,559

(19,984)

-158%

(11,459)

1%

(66,186)

(190,065)

-65%

Backlog Revenues

551,270

587,344

-6%

620,821

-11%

551,270

620,821

-11%

Backlog Results ³

196,812

215,778

-9%

215,758

-9%

196,812

215,758

-9%

Backlog Results Margin ³ 5

35.7%

36.7%

-104 bps

34.8%

95 bps

35.7%

34.8%

95 bps

Net Debt

752,253

765,898

-2%

957,436

-21%

752,253

957,436

-21%

Cash and Cash Equivalents 4

137,160

194,445

-29%

147,462

-7%

137,160

147,462

-7%

Equity + Minority Shareholders

493,191

871,955

-43%

715,069

-31%

493,191

715,069

-31%

(Net Debt – Proj. Fin.) / (Equity + Minorit.)

45.4%

22.7%

2,271 bps

31.4%

1,407 bps

45.4%

31.4%

1,407 bps

¹ Adjusted by capitalized interests and impairmentof inventories and land.

² Adjusted by stock option plan expenses (non-cash), minority shareholders, and impairment of inventories, land, and Alphaville.

³Backlog results net of PIS/COFINS taxes (3.65%) and excluding the impact of PVA (Present Value Adjustment) method according to Law No. 11.638.

4Cash and cash equivalents, and marketable securities.

5Backlogresultscomprisetheprojectsrestrictedbyconditionprecedent.

6Resubmitted by adoption of IRFS 15 and IFRS 9.

2

OPERATIONAL RESULTS

Table 3 - Operational Performance (R$ 000)

4Q18

3Q18

Q/Q (%)

4Q17

Y/Y (%)

12M18

12M17

Y/Y (%)

Launches

118,936

71,144

67,2%

90,113

32,0%

728,670

553,954

31,5%

Gross Sales

153,406

188,125

-18,5%

216,988

-29,3%

1,040,848

1,131,823

-8,0%

Cancellations

(58,401)

(51,661)

13,0%

(95,407)

-38,8%

(227,677)

(411,658)

-44,7%

Net Pre-Sales

95,005

136,464

-30,4%

121,851

-22,0%

813,172

720,164

12,9%

Speed of Sales (SoS)

7,20%

9,40%

-2,2 p,p,

7,40%

-0,2 p,p,

39,90%

32,00%

7,9 p,p,

Delivered PSV

263,254

346,009

-23,9%

41,171

539,4%

910,255

861,325

5,7%

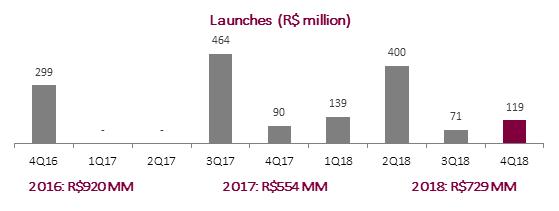

Launches

The Company launched one project in 4Q18, the Scena Tatuapé, with total PSV of R$118.9 million, which, when added to other launches in the year, totaled R$728.7 million in 2018, 31.5% higher than the total volume launched in 2017. In 4Q18, the estimated launch of three other projects with a PSV of approximately R$320 million was postponed to 2019. One of the projects was located in an oversupplied region; the two other projects, located in regions that did not reach an adequate development level, required adjustments.

Table 4 - Launches (R$ 000)

Project

City

Period

PSV

Upside Pinheiros

São Paulo/SP

1Q18

138,715

Upside Paraíso

São Paulo/SP

2Q18

147,949

Belvedere Lorian

Osasco/SP

2Q18

165,130

MOOV Belém

São Paulo/SP

2Q18

86,797

Vision Pinheiros

São Paulo/SP

3Q18

71,144

Scena Tatuapé

São Paulo/SP

4Q18

118,936

TOTAL

728,671

3

Sales

In 4Q18, gross sales totaled R$153.4 million, down 18.5% quarter-over-quarter and 29.3% year-over-year. This quarter was a period marked by transformation. Sales lists and several business conditions were reassessed, with the goal of preserving margin and profitability. For instance, we increased the percentage of clients’ down payments, which had the initial effect of reducing the speed of sales in the quarter—but will ensure healthier sales and fewer dissolutions going forward.

In the last 12 months, gross sales totaled R$1.04 billion in 2018 versus R$1.13 billion in 2017.

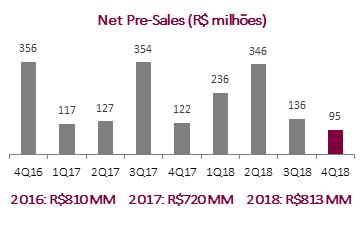

Dissolutions came to R$58.4 million in 4Q18, 38.8% lower than in 4Q17, despite a significantly higher volume of projects delivered year-over-year. Dissolutions reached R$227.7 million in 2018, reflecting a consistent downward trend (-44.7% p.a.). The average monthly dissolutions decreased from R$34.3 million in 2017 to R$19 million in 2018.

The net pre-sales totaled R$95 million in 4Q18. In 2018, net pre-sales came to R$813.2 million, 12.9% higher than in 2017.

4

Sales Over Supply (SoS)

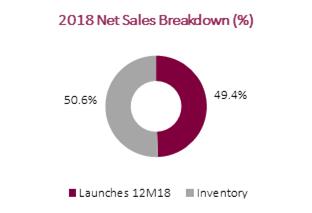

Quarterly SoS was 7.2% in 4Q18, in line with the same period in the previous year. In the last 12 months, SoS reached 40%, 8 p.p. higher than in 4Q17, bolstered by inventory sales and launch successes. With 100% sales, Upside Pinheiros, a project launched in 1Q18, was the highlight.

Inventory (Property for Sale)

Inventory at market value was R$1.225 billion in 4Q18, down 7.1% quarter-over-quarter. This decrease can be attributed to sales in the period as well as sales prices in the quarter that were adjusted with the aim of pricing inventory units at actual market value.

Table 5 – Inventory at Market Value 4Q18 x 3Q18 (R$ 000)

Inventories 3Q18

Launches

Dissolutions

Gross Sales

Adjustments¹

Inventories 4Q18

Q/Q(%)

São Paulo

1,091,812

118,936

46,269

(142,234)

(80,770)

1,034,013

-5.3%

Rio de Janeiro

176,596

-

11,567

(7,253)

(37,747)

143,163

-18.9%

Other Markets

50,290

-

564

(3,919)

954

47,890

-4.8%

Total

1,318,698

118,936

58,401

(153,406)

(117,563)

1,225,066

-7.1%

¹Adjustments reflect the updates related to the project scope, launch date, and pricing update in the period.

The positive inventory sales performance decreased inventory turnover from 25 months in 4Q17 to 18 months at the end of 2018.

We emphasize that out of R$460.6 million finished units, approximately 60% are residential units, which should contribute to sustaining the current level of inventory turnover and the monetization of these assets over the upcoming months. In addition, we point out that 73.5% of total inventory are residential units located in the state of São Paulo, where we are well-positioned to seize opportunities that result from the economic upturn.

5

Table 6 – Inventory at Market Value – Financial Progress – POC - (R$ 000)

Not Initiated

Up to 30% built

30% to 70% built

More than 70% built

Finished Units

Total 4Q18

São Paulo

181,745

75,514

365,287

127,304

284,164

1,034,013

Rio de Janeiro

-

-

-

-

143,163

143,163

Other Markets

-

-

14,647

-

33,243

47,890

Total

181,745

75,514

379,934

127,304

460,570

1,225,066

Table 7 – Inventory at Market Value – Commercial x Residential Breakdown - (R$ 000)

GFSA Inventory %

Residential

Commercial

Total

São Paulo

900,948

133,065

1,034,013

Rio de Janeiro

41,905

101,258

143,163

Other Markets

47,890

-

47,890

Total

990,743

234,323

1,225,066

Delivered Projects and Transfer

In 4Q18 alone, the Company delivered four projects totaling 549 units, with total PSV reaching R$263.3 million, fives times higher than the R$41.1 million seen in 4Q17. Currently, Gafisa has 14 projects underway, four of which will start works in 2019.

Table 8 – Deliveries

Project

Delivery Date

Launch Date

Location

% Share

Units 100%

PSV % R$000

Mood Lapa

May/18

Aug/15

Rio de Janeiro/RJ

100%

153

87,775

Smart Vila Madalena

Jun/18

Oct/15

São Paulo/SP

100%

230

82,190

Vision Paulista

Jun/18

Apr/15

São Paulo/SP

100%

200

88,151

Barra Viva 2

Jun/18

Sep/15

São Paulo/SP

50%

221

21,462

Barra Viva 1 – Torre Alegria

Jun/18

Aug/16

São Paulo/SP

50%

221

21,414

Vision Capote Valente

Jul/18

Nov/15

São Paulo/SP

100%

151

97,414

Bosque Marajoara

Aug/18

Jun/15

São Paulo/SP

100%

339

164,691

Smart Santa Cecília

Sep/18

Oct/15

São Paulo/SP

100%

290

83,904

Scena Alto da Lapa

Oct/18

Oct/15

São Paulo/SP

100%

42

52,119

Alphamall

Nov/18

Sep/15

Rio de Janeiro/RJ

100%

53

24,272

Hermann Jr

Dec/18

Oct/15

São Paulo/SP

100%

22

111,343

Barra Vista

Dec/18

Dec/16

São Paulo/SP

50%

432

75,520

Total 4Q18

549

263,254

Total 2018

2,354

910,255

6

PSV transferred in 4Q18 was up 10%, reaching R$82.4 million year-over-year, boosted by higher PSV of projects delivered. In 2018, PSV transferred totaled R$321.3 million, down 27.2% from 2017. This reduction is because approximately 71% of PSV delivered in the quarter occurred in December (Hermann Jr and Barra Vista), with transfer foreseen in the first quarter of 2019.

Table 9 – Transfer and Deliveries - (R$ 000)

4Q18

3Q18

Q/Q (%)

4Q17

Y/Y (%)

12M18

12M17

Y/Y (%)

PSV Transferred¹

82,400

93,027

-11.42%

74,824

10.13%

321,262

441,217

-27.19%

Delivered Projects

4

3

33.33%

1

300.00%

12

9

33.33%

Delivery Units

549

780

-29.62%

293

87.37%

2,354

2,182

7.88%

Delivered PSV²

263,254

346,009

-23.92%

41,171

539.42%

910,255

861,325

5.68%

¹PSVtransferred refers to the potential sales value of the units transferred to financial institutions;

²PSV = Potential sales value of delivered units.

Landbank

The Company’s landbank, with an estimated PSV of R$3.75 billion, represents 32 potential projects/phases, totaling 6,620 units. Approximately 70% of land was acquired through swaps and was mostly located in the city of São Paulo.

Table 10 - Landbank (R$ 000)

PSV

(% Gafisa) ¹

% Swap Total ²

% Swap Units

% Swap Financial

Potential Units

(% Gafisa) ³

Potential

Units Total

São Paulo

2,410,522

79.2%

73.6%

5.5%

4,816

5,107

Rio de Janeiro

748,745

60.1%

60.1%

0.0%

755

892

Other Markets

594,327

30.0%

30.0%

0.0%

1,050

1,320

Total

3,753,594

69.8%

66.2%

3.6%

6,620

7,319

¹ The PSV (% Gafisa) reported is net of swap and brokerage rate.

²The swap percentage is measured compared to the historical cost of land acquisition.

³Potential units are net of swaps and refer to the Gafisa’s and/or its partners’ interest in the project.

Table 11 – Changes in the Landbank (4Q18 x 3Q18 - R$ 000)

Initial Landbank

Land Acquisition

Launches

Dissolutions

Adjustments

Final Landbank

São Paulo

2,645,527

-

118,936

-

(116,069)

2,410,522

Rio de Janeiro

1,230,529

-

-

-

(481,784)

748,745

Other Markets

43,074

-

-

-

551,253

594,327

Total

3,919,130

-

118,936

-

(46,600)

3,753,594

*The amounts reported are net swap and brokerage.

7

FINANCIAL RESULTS

Revenue

Net revenues rose to R$960.9 million in 2018, up by 22% from 2017, driven by higher sales volume and work evolution in the period. In 4Q18, nearly 30,5% of net revenue is related to projects launched during 2018, reflecting our launches assertiveness.

Table 12 – Revenue Recognition (R$ 000)

4Q18

4Q17¹

Launches

Pre-Sales

%

Sales

Revenue

%

Revenue

Pre-Sales

%

Sales

Revenue

%

Receita

2018

36,296

38.2%

58,808

30.5%

-

-

-

-

2017

10,673

11.2%

20,911

10.8%

52,872

43.5%

40,021

11.7%

2016

25,612

27.0%

70,009

36.3%

22,514

18.5%

58,834

17.2%

2015

17,262

18.2%

39,249

20.3%

31,236

25.7%

152,215

44.5%

<2014

5,161

5.4%

3,939

2.0%

14,959

12.3%

90,987

26.6%

Total

95,005

100%

192,917

100.0%

121,581

100%

342,057

100.0%

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

Gross Profit & Margin

In 4Q18, gross profit & margin were impacted by provisions totaling R$63.1 million, deriving from impairmentof certain plots of land and inventory units. Excluding the effect of these adjustments, recurring adjusted gross profit recorded in 4Q18 totaled R$46.9 million versus approximately R$91.6 million in 4Q17. In the last 12 months, recurring adjusted gross profit totaled R$290.8 million in 2018, twice higher than the amount recorded in 2017. Recurring adjusted gross margin in 2018 was 30.3%, 12 p.p. higher than in 2017.

Table 13 – Gross Margin (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17¹

Y/Y (%)

12M18

12M17¹

Y/Y (%)

Net Revenue

192,917

252,306

-24%

342,057

-44%

960,891

786,174

22%

Gross Profit

(29,710)

48,746

-161%

(81,111)

-63%

114,722

(120,312)

-195%

Gross Margin

-15.4%

19.3%

-3,472 bps

-23.7%

831 bps

11.9%

-15.3%

2,724 bps

(-) Financial Costs

(13,506)

(31,584)

-57%

(25,399)

-47%

(112,904)

(116,515)

-3%

Adjusted Gross Profit²

(16,204)

80,330

-120%

(55,712)

-71%

227,626

(3,797)

-6,095%

Adjusted Gross Margin²

-8.4%

31.8%

-4,024 bps

-16.3%

789 bps

23.7%

-0.5%

2,417 bps

(-) Inventory and landbank adjustment

(63,145)

-

-

(147,332)

-57%

(63,145)

(147,332)

-57%

Recurring Adjusted Gross Profit³

46,942

80,330

-42%

91,620

-49%

290,771

143,535

103%

Recurring Adjusted Gross Margin³

24.3%

31.8%

-751 bps

26.8%

-245 bps

30,3%

18.3%

1,200 bps

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

² Adjusted by capitalized interests.

³ Adjusted byimpairment of land and inventories.

8

Selling, General, and Administrative Expenses (SG&A)

Selling, general, and administrative expenses totaled R$6.6 million, 85% below 3Q18 and 86% below 4Q17. In the last 12 months, selling, general, and administrative expenses totaled R$141 million, down 22% from 2017.

Selling expenses totaled R$11.4 million, down 45% from 3Q18 due to a reduction in i)product marketing and selling expenses, reflecting the gains earned during the 4Q18 turnaround process; and ii) brokerage and sales commission expenses, reflecting lower sales volume in the period. In 2018, the decrease was 4% versus 2017.

General and administrative expenses totaled R$4.7 million, down 121% from 3Q18 mainly due to (i) the net reversal of bonus provisions for the previous year and current year, amounting to R$14.8 million in 2018; (ii) reduced services expenses; and (iii) lower salaries and charges expenses. In the last 12 months, general and administrative expenses decreased from R$92.7 million in 2017 to R$57.1 million in 2018 due to a reversal of provision for bonus mentioned above as well as lower services and IT expenses.

Table 14 – SG&A Expenses (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17

Y/Y (%)

12M18

12M17

Y/Y (%)

Selling Expenses

(11,389)

(20,653)

-45%

(24,399)

-53%

(84,431)

(87,568)

-4%

G&A Expenses

4,752

(22,300)

-121%

(24,165)

-120%

(57,089)

(92,713)

-38%

Total SG&A Expenses

(6,637)

(42,953)

-85%

(48,564)

-86%

(141,520)

(180,281)

-22%

In contrast to other periods in the year, the total amount of other operating expenses reached R$251.4 million in 4Q18, 67% higher than in 4Q17. A significant amount of this total, 45% or R$112.8 million derived from the goodwill impairment test to remeasure the 30% stake in Alphaville, yearly conducted based on the future profitability estimate or when circumstances indicate impairment losses.

Another relevant impact in the quarter was the expense relating to provision for contingencies. During the revision of contingency proceedings, we identified a provisioning need for four relevant contingencies: (i) execution referring to the loss of suit totaling R$33.7 million; (ii) indemnification in affirmative covenant involving former shareholder of the Company, in the amount of R$26.7 million; (iii) lawsuit referring to construction guarantee totaling R$23.2 million, the injunction of which was granted relief on March 7, 2017 ; and (iv) indemnification due to land dissolution, with judgment rendered on September 9, 2015, totaling R$23.3 million. Furthermore, it is important to note that the impairment of software reached approximately R$5 million.

Table 15 – Other Operating Revenues/Expenses (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17

Y/Y (%)

12M18

12M17

Y/Y (%)

Litigation Expenses

(127,668)

(17,241)

640%

(46,417)

175%

(172,432)

(107,848)

60%

Impairment of Alphaville

(112,800)

-

-

(101,953)

11%

(112,800)

(101,953)

11%

Impairment of Software

(4,963)

-

-

(710)

599%

(4,963)

(710)

599%

Others

(6,003)

(337)

1,681%

(1,166)

415%

(8,741)

(1,039)

741%

Total

(251,434)

(17,578)

1,330%

(150,246)

67%

(298,936)

(211,550)

41%

9

Adjusted EBITDA

Recurring adjusted EBITDA (excluding litigation expenses and the impairment of inventories, land, software and investment losses in Alphaville) amounted to positive R$127 million in 2018 versus negative R$50,8 million in 2017. In 4Q18, adjusted EBITDA according to the same criteria totaled positive R$29.3 million, 34% below 4Q17.

Table 16 – Adjusted EBITDA (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17¹

Y/Y (%)

12M18

12M17¹

Y/Y (%)

Net Income (Loss)

(297,017)

(37,225)

698%

(372,998)

-20%

(419,526)

(760,240)

-45%

Discontinued Operation Result

-

-

-

-

-

-

(98,175)

-100%

(+) Inventory and landbank adjustment

63,145

-

-

147,332

-57%

63,145

147,332

-57%

Adjusted Net Income

(233,872)

(37,225)

528%

(225,666)

4%

(356,381)

(711,083)

-50%

(+) Financial Results

22,310

19,179

16%

24,249

-8%

80,521

107,268

-25%

(+) Income Tax / Social Contribution

(24,085)

670

-3,695%

(24,773)

-3%

(21,751)

(23,100)

-6%

(+) Depreciation and Amortization²

5,772

6,393

-10%

6,084

-5%

21,290

32,046

-34%

(+) Capitalized Interest

13,506

31,584

-57%

25,399

-47%

112,904

116,515

-3%

(+) Expenses w Stock Option Plan

15

634

-98%

2,067

-99%

1,927

4,964

-61%

(+) Minority Shareholders

170

(700)

-124%

(161)

-206%

(1,750)

(281)

523%

(+) AUSA Income Effect

-

-

-

62,569

-100%

-

186,856

-100%

(+) AUSA loss on investment realization Effect

112,800

-

-

127,429

-11%

112,800

127,429

-11%

(+) Litigation Expenses

127,668

17,241

640%

46,417

175%

172,432

107,848

60%

(+) Impairment of Software

4,963

-

-

710

599%

4,963

710

599%

Recurring Adjusted EBITDA³

29,247

37,776

-23%

44,324

-34%

126,954

(50,828)

-350%

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

² Adjusted by goodwill impairment test to remeasure the acquisition of Alphaville.

³ Adjusted by capitalized interests, litigation and stock option plan expenses (non-cash), minority shareholders, and impairmentof inventories, land, software and Alphaville.

Financial Result

In 4Q18, financial results totaled R$4.3 million, down 29% quarter-over-quarter, reflecting lower balance of cash and cash equivalents in the period; and down 28% year-over-year, due to the interest rate drop in the period. Financial expenses reached R$26.7 million in 4Q18, 12% lower than in 4Q17 due to reduced interest rates on funding in view of a lower level of indebtedness. Thus, 4Q18 reported a negative net financial result of R$22.3 million, compared to a negative net financial result of R$24.3 million in 4Q17.

In the last 12 months, the net financial result was negative R$80.5 million versus a net loss of R$107.3 million in 2017.

Taxes

In 4Q18, income tax and social contribution had a positive impact of R$24 million, reflecting a tax credit of R$26 million deriving from the goodwill impairment recorded in the Alphaville investment. For this

reason, the provision for income tax and social contribution (IR/CSLL) had a positive impact of R$21.8 million in 2018.

10

Net Result

As a result of effects mentioned above, 4Q18’s recorded a positive result of R$11.6 million, compared to a net loss of around R$20 million in 3Q18 and in line with R$11.5 million in 4Q17, excluding results from the impairment of inventories, land, and goodwill of the stake in Alphaville. In the last 12 months, recurring adjusted net loss was R$66.2 million versus R$190.1 million in 2017.

Table 17 – Net Result (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17¹

Y/Y (%)

12M18

12M17¹

Y/Y (%)

Net Revenue

192,917

252,306

-24%

342,057

-44%

960,891

786,174

22%

Gross Profit

(29,710)

48,746

-161%

(81,111)

-63%

114,722

(120,312)

-195%

Gross Margin

-15.4%

19.3%

-3,472 bps

-23.7%

8,312 bps

11.9%

-15.3%

2,724 bps

(-) Financial Costs

(13,506)

(31,584)

-57%

(25,399)

-47%

(112,904)

(116,515)

-3%

(-) Inventory and landbank adjustment

(63,145)

-

-

(147,332)

-57%

(63,145)

(147,332)

-57%

Recurring Adjusted Gross Profit

46,942

80,330

-42%

91,620

-49%

290,771

143,535

103%

Recurring Adjusted Gross Margin

24.3%

31.8%

-751 bps

26.8%

2,453 bps

30.3%

18.3%

1,200 bps

Adjusted Net Income²

(233,872)

(37,225)

528%

(225,666)

4%

(356,381)

(612,908)

-42%

( - ) Equity income from Alphaville

-

-

-

(62,569)

-100%

-

(186,856)

-100%

( - ) Loss of investment in Alphaville

(112,800)

-

-

(127,429)

-11%

(112,800)

(127,429)

-11%

(-) Litigation Expenses

(127,668)

(17,241)

640%

(46,417)

175%

(172,432)

(107,848)

60%

(-) Impairment of Software

(4,963)

-

-

(710)

599%

(4,963)

(710)

599%

Recurring Adjusted Net Result³

11,559

(19,984)

-158%

11,459

1%

(66,186)

(190,065)

-65%

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

² Adjusted by impairmentof inventories and land.

³ Adjusted by capitalized interests, litigation expenses, impairmentof inventories, land, software and Alphaville.

Backlog of Revenues and Results

The balance of backlog revenues totaled R$196.8 million in 4Q18, with a margin to be recognized of 35.7%, 95 basis points higher than in 4Q17.

Table 18 – Backlog Results (REF) (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17

Y/Y (%)

Backlog Revenues

551,270

587,344

-6%

620,821

-11%

Backlog Costs (units sold)

(354,458)

(371,566)

-5%

(405,064)

-12%

Backlog Results

196,812

215,778

-9%

215,758

-9%

Backlog Margin

35.7%

36.7%

-104 bps

34.8%

95 bps

Note:Backlogresultsnet ofPIS/COFINStaxes( 3.65%)andexcludingtheimpactofPVA(PresentValueAdjustment)methodaccordingtoLaw No. 11.638.

Backlogresultscomprisetheprojectsrestrictedbyconditionprecedent.

11

BALANCE SHEET

Cash and Cash Equivalents and Marketable Securities

On December 31, 2018, cash and cash equivalents and marketable securities totaled R$137.2 million.

Receivables

At the end of 4Q18, total accounts receivable totaled R$1.2 billion, down 13% versus 3Q18. Of this amount, R$642 million were already recognized in the balance sheet, and R$468 million are expected to be received in 2019.

Table 19 – Total Receivables (R$ 000)

4Q18

3Q18

Q/Q(%)

4Q17

Y/Y (%)

Receivables from developments (off balance sheet)

572,154

609,594

-6%

644,340

-11%

Receivables from PoC- ST (on balance sheet)

467,992

569,166

-18%

374,886

25%

Receivables from PoC- LT (on balance sheet)

174,018

214,405

-19%

199,317

-13%

Total

1,214,164

1,393,165

-13%

1,218,543

-0,4%

Notes: ST – Short term | LT- Long term | PoC – Percentage of Completion Method.

Receivables from developments: accounts receivable not yet recognized according to PoC and BRGAAP.

Receivables from PoC: accounts receivable already recognized according to PoC and BRGAAP.

Table 20 – Receivables Schedule (R$ 000)

Total

2019

2020

2021

2022

2023 – and after

Receivables from PoC

642,010

467,992

108,726

59,753

1,413

4,126

Cash Generation

Cash generation totaled R$13.7 million in 4Q18 due to greater control of expenses in the quarters, a result of the Company’s turnaround process.

Table 21 – Cash Generation (R$ 000)

1Q18

2Q18

3Q18

4Q18

Availabilities 1

204,938

212,897

194,445

137,160

Change in Availabilities (1)

57,476

7,959

(18,452)

(57,285)

Total Debt + Investor Obligations

983,468

964,770

960,344

889,413

Change in Total Debt + Investor Obligations (2)

(121,430)

(18,698)

(4,426)

(70,931)

Capital Increase (3)

250,766

-

-

-

Cash Generation in the period (1) - (2) - (3)

(71,860)

26,657

(14,026)

13,646

Final Accumulated Cash Generation

(71,860)

(45,203)

(59,229)

(45,583)

¹ Cash and cash equivalents. and marketable securities.

12

Liquidity

In 4Q18, net debt reached R$752.3 million, down 21.0% year-over-year.

Table 22 – Debt and Investor Obligations (R$ 000)

4Q18

3Q18

Y/Y(%)

4Q17

Y/Y (%)

Debentures – Working Capital (A)

265,666

281,325

-6%

207,713

28%

Project Financing SFH – (B)

528,140

567,696

-7%

733,103

-28%

Working Capital (C)

95,607

111,323

-14%

164,082

-42%

Total Debt (A)+(B)+(C)= (D)

889,413

960,344

-7%

1,104,898

-20%

Cash and Availabilities ¹ (E)

137,160

194,446

-29%

147,462

-7%

Net Debt (D)-(E) = (F)

752,253

765,898

-2%

957,436

-21%

Equity + Minority Shareholders (G)

493,191

871,955

-43%

715,069

-31%

(Net Debt) / (Equity) (F)/(G) = (H)

152.5%

87.8%

6,469 bps

133.9%

1,863 bps

(Net Debt – Proj, Fin,) /Equity ((F)-(B))/(G) = (I)

45.4%

22.7%

2,271 bps

31.4%

1,407 bps

¹ Cash and cash equivalents and marketable securities.

The Company ended 4Q18 with R$348.4 million in total short-term debt, 39% of total debt versus 51.5% at the end of 4Q17. We point out that during 2018, the Company amortized approximately R$639.4 million of debts contracted. On December 31, 2018, the consolidated debt average cost was 11.44% p.a., or 178.2% of CDI accumulated in 2018.

Table 23 – Debt Maturity (R$ 000)

Average Cost (a.a.)

Total

Until Dec/19

Until Dec/20

Until Dec/21

Until Dec/22

Debentures – Working Capital (A)

CDI + 3% / CDI + 3.75% / CDI + 5.25% / IPCA + 8.37%

265,666

62,783

157,700

43,391

1,792

Project Financing SFH (B)

TR + 8.30% a 14.19% / 12.87% / 143% CDI

528,140

250,935

201,035

76,170

-

Working Capital (C)

135% CDI / CDI + 2.5% / CDI + 3% / CDI + 3.70% / CDI + 4.25%

95,607

34,678

15,583

45,346

-

Total (A)+(B)+(C) = (D)

889,413

348,396

374,318

164,907

1,792

Obligations with investors (E)

-

-

-

-

-

Total Debt (D)+(E) = (F)

889,413

348,396

374,318

164,907

1,792

% of Total Maturity per period

39%

42%

19%

0.2%

Project debt maturing as % of total debt (C)/ (F)

72%

54%

46%

-

Corporate debt maturing as % of total debt ((A)+(C) + (E))/ (F)

28%

46%

54%

100%

Ratio Corporate Debt / Mortgage

40.6% / 59.4%

13

SUBSEQUENT EVENTS

New Headquarters Address

On January 8, 2019, a lease agreement was signed for the Company’s new headquarters in São Luiz Condominium, at Av. Pres. Juscelino Kubitschek, 1830. With our headquarters moving to a location better-suited to us, there will be a reduction in leasing, condominium, and IPTU (municipal real estate tax) expenses by approximately R$4 million p.a.

Change in Relevant Shareholding

GWI’s reduced stake

On February 14, 2019, the GWI Group reduced its stake in the Company to 7.70% of common shares issued by the Company (3,338,600 shares). On February 20, 2019, GWI Group then held 2,199,300 shares, accounting for 4.89% of the Company’s capital stock, no longer holding relevant shareholding in Gafisa.

Planner’s increased interest

On February 14, 2019, Planner, by means of investment funds managed by it, reached an equity interest of eight million (8,000,000) common shares issued by Gafisa, corresponding to 18.45% of total common shares issued by the Company. In a notice sent to the Company, Planner stated its intention to change Gafisa’s administrative structure, undertaking to keep the market informed on this issue.

Change in the Board of Directors

On February 17, 2019, the following Messrs. were elected to hold two remaining positions in the Company’s Board of Directors, with terms lasting until the next General Meeting of the Company:

Augusto Marques da Cruz Filho:Augusto holds a PhD in Economic Theory from the Institute of Economic Research (IPE) of the University of São Paulo, graduated in Economic Sciences from the Economic and Administration University of the University of São Paulo (FEA-USP), and attended Abroad Developmente in Insead – Institut Européen d’Aministration des Affaires. For 11 years he has occupied various roles at Grupo Pão de açúcar: Executive Officer, Administrative and Financial Officer, and Chief Officer until leaving the position in 2005. Between 2005 and 2010 he was a member of the Board of Directors and Audit Committee of B2W. Since April 2016, he has been President of the Board of Directors of BR Distribuidora. He is also a member of the Board of Directors of JSL S.A. and General Shopping.

Oscar Segall: Oscar is a strong figure in the Brazilian real estate market. He co-founded Klabin Segall and headed BTG Pactual’s real estate department. He led the launch of over 130 projects, delivered more than 25,000 units, and won several real estate awards. In addition to his vast experience in the domestic market, Oscar has experience buying and selling land in the US market and developing real estate projects.

On this same date, Messrs. Mu Hak You and Thiago Hi Joon You tendered their resignation as members of the Board of Directors, which continues being composed of five (5) sitting members.

14

On March 15, 2019, the following Messrs. were elected to hold two remaining positions in the Company’s Board of Directors, with a term of office until the next Shareholders’ Meeting of the Company:

Thomas Reichenheim: he holds a degree in Business Administration from Getúlio Vargas Foundation (1972) and in Law from FMU (Faculdades Metropolitanas Unidas) - 1972. Mr. Reichenheim is a former officer of several companies, notably, Banco Auxiliar, Banco Auxiliar de Investimento, Auxiliar Seguradora, La Fonte Fechaduras, and LFTel S.A. He is the general partner of Carisma Comercial Ltda., T.R Portfolios Ltda. and advisor in IPOs and financial institutions.

Roberto Portella: he is a partner of the law firm Demarest Almeida, Advisory Sector, member of the Legal Committee of the American Chamber for Brazil (AMCHAN-SP), member of Petro S.A.’s Fiscal Council.

The Board of Directors is now composed of 7 sitting members.

Annual Shareholders’ Meeting

In view of the nomination of new members of the Board of Directors, and the new composition of the Audit Committee, with a 2/3 change of its members to better assess the financial statements, the Company altered the date of the Annual Shareholders’ Meeting from April 24, 2019, to April 30, 2019.

Extraordinary Shareholders’ Meeting

On March 15, 2019, the Company received a letter from Planner Corretora de Valores S.A. and Planner Redwood Asset Management Administração de Recursos Ltda. (both jointly referred to as “Planner”), in the capacity of investment fund managers, which jointly hold 18.55% of Gafisa’s capital stock, requesting the Company’s Board of Directors to call for an Extraordinary Shareholders’ Meeting (“ESM”). Referred Planner’s call for an ESM follows its intention of altering Gafisa’s administrative structure.

The Extraordinary Shareholders’ Meeting is scheduled for April 15, 2019, at 9:00 a.m. at the Company’s headquarters.

15

São Paulo, March 28, 2019.

Alphaville Urbanismo SA released its results for the fourth quarter of 2018.

Financial Results

In 4Q18, net revenue came in at negative R$32 million and net loss totaled R$222 million.

4Q18

4Q17

12M18

12M17

4Q18 vs. 4Q17

2018 vs. 2017

Net revenue

-32

-45

69

108

-29%

-36%

Net Income

-222

-350

-755

-764

-37%

-1%

It is worth mentioning that Gafisa discontinued the recognition of its share in future losses after reducing the accounting balance of its 30% stake in Alphaville's share capital to zero.

For further information, please contact our Investor Relations team atri@alphaville.com.bror +55 11 3038-7131.

16

Consolidated Income Statement

4Q18

3Q18

Q/Q (%)

4Q17¹

Y/Y (%)

12M18

12M17¹

Y/Y (%)

Net Revenue

192,917

252,306

-24%

342,057

44%

960,891

786,174

22%

Operating Costs

(222,627)

(203,560)

9%

(423,168)

-47%

(846,169)

(906,486)

-7%

Gross Profit

(29,710)

48,746

-161%

(81,111)

-63%

114,722

(120,312)

-195%

Gross Margin

-15.4%

19.3%

-3,472 bps

-6.5%

-892 bps

11.9%

-15.3%

2,724 bps

Operating Expenses

(268,912)

(66,822)

302%

(292,572)

-8%

(477,228)

(654,216)

-27%

Selling Expenses

(11,389)

(20,653)

-45%

(24,399)

-53%

(84,431)

(87,568)

-4%

General and Administrative Expenses

4,752

(22,300)

-121%

(24,165)

-120%

(57,089)

(92,713)

-38%

Other Operating Revenue/Expenses

(251,434)

(17,578)

1,330%

(150,246)

67%

(298,935)

(211,550)

41%

Depreciation and Amortization

(5,772)

(6,393)

-10%

(31,560)

-82%

(21,290)

(57,522)

-63%

Equity Income

(5,069)

102

-5,070%

(62,202)

-92%

(15,483)

(204,863)

-92%

Operational Result

(298,622)

(18,076)

1,552%

(373,683)

-20%

(362,506)

(774,528)

-53%

Financial Income

4,342

6,130

-29%

6,053

-28%

19,553

29,733

-34%

Financial Expenses

(26,652)

(25,309)

5%

(30,302)

-12%

(100,074)

(137,001)

-27%

Net Income Before Taxes on Income

(320,932)

(37,255)

761%

(397,932)

-19%

(443,027)

(881,796)

-50%

Deferred Taxes

25,100

-

-

25,932

-3%

25,100

25,932

-3%

Income Tax and Social Contribution

(1,015)

(670)

51%

(1,159)

-12%

(3,349)

(2,832)

18%

Net Income After Taxes on Income

(296,847)

(37,925)

683%

(373,159)

-20%

(421,276)

(858,696)

-51%

Continued Op. Net Income

(296,847)

(37,925)

683%

(373,159)

-20%

(421,276)

(858,696)

-51%

Discontinued Op. Net Income

-

-

-

-

-

-

98,175

-100%

Minority Shareholders

170

(700)

-124%

(161)

-206%

(1,750)

(281)

523%

Net Income

(297,017)

(37,225)

698%

(372,998)

-20%

(419,526)

(760,240)

-45%

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

17

Consolidated Balance Sheet

4Q18

3Q18

Q/Q (%)

4Q17¹

Y/Y (%)

Current Assets

Cash and Cash equivalents

32,304

7,931

307%

28,527

13%

Securities

104,856

186,515

-44%

118,935

-12%

Receivables from clients

467,993

569,166

-18%

374,886

25%

Properties for sale

890,460

858,726

4%

990,286

-10%

Other accounts receivable

106,943

104,116

3%

110,626

-3%

Prepaid expenses and other

2,668

3,184

-16%

5,535

-52%

Land for sale

78,148

34,212

128%

102,352

-24%

Non-current asset for sale

-

-

-

-

-

SubTotal

1,683,371

1,763,850

-5%

1,731,147

-3%

Long-term Assets

Receivables from clients

174,017

214,405

-19%

199,317

-13%

Properties for sale

198,941

263,937

-25%

339,797

-41%

Other

123,603

116,874

6%

86,351

43%

Subtotal

496,561

595,216

-17%

625,465

-21%

Intangible, Property and Equipment

31,843

43,047

-26%

40,622

-22%

Investments

314,505

465,438

-32%

479,126

-34%

Total Assets

2,526,280

2,867,551

-12%

2,876,360

-12%

Current Liabilities

Loans and financing

285,612

170,171

68%

481,073

-41%

Debentures

62,783

31,196

101%

88,177

-29%

Obligations for purchase of land advances

from customers

113,355

145,468

-22%

156,457

-28%

Material and service suppliers

119,847

106,363

13%

98,662

21%

Taxes and contributions

57,276

56,822

1%

46,430

23%

Other

400,142

297,503

35%

385,444

4%

Subtotal

1,039,015

807,523

29%

1,256,243

-17%

Long-term liabilities

Loans and financings

338,135

508,848

-34%

416,112

-19%

Debentures

202,883

250,129

-19%

119,536

70%

Obligations for Purchase of Land and

advances from customers

196,076

207,765

-6%

152,377

29%

Deferred taxes

49,372

74,473

-34%

74,473

-34%

Provision for Contingencies

155,608

98,557

58%

82,063

90%

Other

52,000

48,301

8%

60,487

-14%

Subtotal

994,074

1,188,073

-16%

905,048

10%

Shareholders’ Equity

Shareholders’ Equity

491,317

870,252

-44%

711,222

-31%

Minority Interest

1,874

1,703

10%

3,847

-51%

Subtotal

493,191

871,955

-43%

715,069

-31%

Total liabilities and Shareholders’ Equity

2,526,280

2,867,551

-12%

2,878,360

-12%

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

18

Consolidated Cash Flow

4Q18

4Q17¹

12M18

12M17¹

Net Income (Loss) before taxes

(320,931)

(397,932)

(443,027)

(881,796)

Expenses/revenues that does not impact working capital

203,511

193,567

227,218

481,285

Depreciation and amortization

5,772

6,084

21,290

32,046

Impairment

(35,220)

147,332

(74,689)

136,191

Expense with stock option plan

15

2,066

1,927

4,964

Unrealized interest and fees, net

927

(807)

11,156

46,168

Equity Income

5,069

62,202

15,483

204,863

Provision for guarantee

(474)

3,941

(4,130)

(3,498)

Provision for contingencies

127,668

46,417

172,432

107,848

Profit Sharing provision

(18,545)

3,981

(14,750)

13,375

Provision (reversal) for doubtful accounts

(22,790)

(205,050)

(41,827)

(187,283)

Gain / Loss of financial instruments

-

(28)

(763)

(818)

Impairment losses

112,800

101,953

112,800

101,953

Goodwill write-off AUSA

-

25,476

-

25,476

Stock sale update

28,289

-

28,289

-

Clients

21,332

79,562

(95,740)

260,090

Properties held for sale

132,643

82,661

339,575

346,210

Other accounts receivable

(6,516)

(45)

(15,880)

(9,317)

Prepaid expenses and deferred sales expenses

516

(9)

2,867

(2,987)

Obligations on land purchase and advances from clients

(43,802)

40,037

597

13,137

Taxes and contributions

454

(3,982)

10,846

(5,412)

Suppliers

24,202

8,163

32,732

18,683

Payroll, charges, and provision for bonuses

(9,539)

(5,379)

(6,459)

(14,266)

Other liabilities

59,599

15,052

(3,434)

(20,341)

Related party operations

(2,055)

(4,642)

(14,497)

(27,548)

Taxes paid

(1,014)

(1,159)

(3,348)

(2,832)

Cash provided by/used in operating activities /discontinued operation

-

-

-

51,959

Net cash from operating activities

58,390

5,924

31,450

206,865

Investment Activities

-

-

-

-

Acquisition of properties and equipment

5,432

(2,093)

(12,511)

(20,463)

Capital contribution to parent company

(641)

(3,892)

(4,629)

(2,598)

Redemption of securities, collaterals, and credits

222,333

332,660

1,104,875

1,183,878

Investment in marketable securities and restricted credits

(140,674)

(322,223)

(1,090,796)

(1,079,167)

Cash provided by/used in investment activities / discontinued operation

-

-

-

48,663

Transaction costs from discontinued operation

-

-

-

(9,545)

Receivable of preemptive right exercise ref, Tenda

-

-

-

219,510

Net cash from investment activities

-

105,170

-

105,170

Cash provided by/used in investment activities / discontinued operation

86,450

109,622

(3,061)

445,448

Funding Activities

-

-

-

-

Related party contributions

-

-

-

(1,237)

Addition of loans and financing

34,927

197,565

412,768

453,370

Amortization of loans and financing

(106,785)

(311,130)

(639,409)

(1,032,206)

Assignment of credit receivables, net

-

-

-

21,513

Related Parties Operations

(446)

(581)

(1,289)

5,044

Sale of treasury shares

-

501

715

818

Cash provided by/used in financing activities/ discontinued operation

-

-

-

24,089

Proceeds from sale of treasury shares

(48,163)

-

(48,163)

-

Capital Increase

-

-

167

-

Subscription and payment of common shares

-

-

250,599

-

Net cash from financing activities

(120,467)

(113,645)

(24,612)

(528,609)

Net cash variation for sales operations

-

-

-

(124,711)

Increase (decrease) in cash and cash equivalents

24,373

1,901

3,777

(1,007)

Beginning of the period

7,931

26,626

28,527

29,534

End of the period

32,304

28,527

32,304

28,527

Increase (decrease) in cash and cash equivalents

24,373

1,901

3,777

(1,007)

¹ Resubmitted by adoption of IRFS 15 and IFRS 9.

19

This release contains forward-looking statements about business prospects, estimates for operating and financial results, and Gafisa’s growth prospects. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy, and the industry, among other factors; therefore, they are subject to change without prior notice.

20

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 28, 2019

Gafisa S.A.

By:

/s/ Ana Maria Loureiro Recart

Name: Ana Maria Loureiro Recart

Title: Chief Executive Officer

GRAPHIC

2

x19032818431501.jpg

GRAPHIC

begin 644 x19032818431501.jpg

M_]C_X 02D9)1@ ! 0$ 8 !@ #_VP!# @&!@7J#A(6&AXB)BI*3E)66EYB9FJ*CI*6FIZBIJK*SM+6VM[BYNL+#Q,7&

MQ\C)RM+3U-76U]C9VN'BX^3EYN?HZ>KQ\O/T]?;W^/GZ_\0 'P$ P$! 0$!

M 0$! 0 $" P0%!@'EZ@H.$

MA8:'B(F*DI.4E9:7F)F:HJ.DI::GJ*FJLK.TM;:WN+FZPL/$Q;GZ.GJ\O/T]?;W^/GZ_]H # ,! (1 Q$ /P#W^BBB@ HH

MHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB

M@ HJ$7=LUVUH+B(W*H)&A#C>%)P&*]<9[U-0 4444 %%%4H=5LKC5;K3(IMU

MY:JCS1[&&T/]WGG'8T#2;V+M%%% @HI&941G8A549))X K'3Q9X?>PMKY]

M7M(+>Y#&![F00^8 CV.B-K$FHVS6.UBDJ3*5E

M(S\J'.&;@C&>M3:+K%IKVD6^I6+[H)T# %E)4]U;:2 P[C/% .$DN9K0OT45

M!BKGJ?84$I-[$]%82>,_#SW'D?VG&C[YD)D1

MD4&+'F99@ ,CDG'I6U%+'<0I-#(DD4BAD=&!5@>001U%!4H2C\2L/HHJDFJ

MV3ZQ)I(G_P!.CA$[0E2#Y9. P)&",\Q=HHHH$%%%% !1110 4444

M%%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4

M444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% '(V

MO_)6=0_[!$/_ *,:LSQ7XAU"&^UJ/2]2OE;3+19'2UM[81P.5+ RM,V7S@IKL+[0-&U.<3ZAI%A=S!=HDN+9)&QZ9(SBF7/AK0;UT>ZT339V1!&K2VJ

M,54=%&1P!Z4[HZ8U8*2E)7TLE8'AKQ%XD\3:OI=F?$$EO#-;7,\KPVT+-)LF9% )0@<8YP>GOFO2;G0

MM(O;:"VNM*L9X+<8ABEMT98QTPH(P.@Z4ZTT;2[!XWL]-L[=XT*(T,"H54G)

M P. 3SCUIW17MJ:3M'7Y>?\ G^!YSX=\5:[XBN;+3[G7$TXI93S27,^X=

M)60'#J5 7<0/?H.D,/]IR^*?$]_8^) 'M])@E:YM+>)DNG$9*M\VX!>#D+U

MSU&*]'E\.:'<6\=O-HVG20Q,S1QO:H50L

GRAPHIC

3

x19032818431502.jpg

GRAPHIC

begin 644 x19032818431502.jpg

M_]C_X 02D9)1@ ! 0$ 8 !@ #_VP!# @&!@7J#A(6&AXB)BI*3E)66EYB9FJ*CI*6FIZBIJK*SM+6VM[BYNL+#Q,7&

MQ\C)RM+3U-76U]C9VN'BX^3EYN?HZ>KQ\O/T]?;W^/GZ_\0 'P$ P$! 0$!

M 0$! 0 $" P0%!@'EZ@H.$

MA8:'B(F*DI.4E9:7F)F:HJ.DI::GJ*FJLK.TM;:WN+FZPL/$Q;GZ.GJ\O/T]?;W^/GZ_]H # ,! (1 Q$ /P#W^BBB@ HH

MHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBL

MNY\2Z%9W+V]SK%A#/&')>_M+8P^?=0Q>>X2+>X'

MF,>@'J:L4!9A115+5-5LM&L3>7\WDVX94+[2W+' X'N: 2;=D7:* Y

M@M8))YYDBBC&7=V "CU)[4"):*9%+'/"DT+K)&ZAD=3D,#T(-/H ***1W6-&

M=V"JHR2>@% "T5C1^*]!>QM[UM4MH;>Y!,+3OY7F '!(#8)%27GB32++16U9

M[^W>S"DI(DJD2$9^53G!/!XHL7[.=[6-6BL_1=8M->TFWU*R?=#,NX D$H>Z

MM@G!'<5H4$M-.S"BH+B]M;1H5N;B*%IG$<0D,]0OHDU71)]2.I6L7V6=9710\+&51L

M8H ISU'&:]+B\/:+!;36T.DV,N:J:;+?Z=:>--1BUFY:YMOW@5TB(=O)!#$;>WM@<5Z-=^'M%O[@W%YI

M-C<3$ &26W5F..G)%/DT/29;B2>33+-YI$\MY&@4LRXQM)QR,<8HNB5B*:5E

M'?T\O\OQ.%T[7=7UNYU"*77?[*6QT^"5-L4?[UGCW-*VY3\H/&%Q69I'B3Q/

MXA_M6Y;66L5L=,6X6&&VC(=RI(;+J3M.W./>O2[K0-&O?*^U:593^4@2/S(%

M;8HZ 9' ]JL#3K$/,XLX \Z".5O+&9% P%/J,=J+H/K%-)VC^"_K4\SM_%NM

M31VFK7>KK%I[I:[_ +''%*L3MC>LR'YQN/0KT!KL_'5Q+;^!=8F@.'%LP! [

M'@_H:OCP[HBSQ3KI%@)HMOEN+=-R;>F#CC':KE[:17]C<6H(P:

M5T1.K!SC)*UCSZ[M[A?$?@^#2I+:&1=,E$9GB,B8V)V!'YYJCX>TZVOHK0KJ

M5O8>);'4;EI+>.\N;&,PQ731!

M7"=@.N., \\XJ'7O!^C>(;2:"[M(T>9UD>>)%64EN>?6N;MM1\420^$]WB:4

MOKFXS-]EBQ& PV#;UQD9.>N<5Z9;:?9V=E]CMK6&*VP1Y*1@+@]>!QS2+IM

M@OV;;96X^R_\>^(A^ZXQ\O\ =X]*5R%6@F[1_7IY^>IYW#XIUJ.[M["2_P#.

M:'Q";"29HD#2P[CZ9%,)H]/M4E!9@ZPJ#EOO'.._?UIW+6)@DTH[H\P\

M'^)]=\46FH->^(/[-:QM0Z%(8AYI.X^8VY2-HP!A<4:1XD\3^(?[5N6UEK%+

M'3%N%BAMHR'-QQG!P._;/O6/=F!]4G-MM;7A>.4*_P"M\GRSC_@&,>V?>@#NPP;H0<=<

M&EKDO"O]GF_9M)$?D&SC^TF,1W$M];DXC\QOLOSJ4.?W3;OD!].:

MH_\ "R-)_P"?:]_[X7_XJC_A9&D_\^U[_P!\+_\ %4 =C169HFMV^O6;W5M'

M*B)(8R) V

M*Z(D 9)Q2;U_O#\Z ..M4N+NTU*TTJR:%'NPQCNH9+9'AVJ"%.SOC'3I6[X<

M2ZBT6&.\MX[>52P\M&+ #)QU K4WK_>'YT!@>A!_&@!:*** "BBB@ HHHH *

M*** "BBB@ HHHH **Y9O$LZ>(?L;36F&N#;K9[3Y^-A829SR"1TQT/6KGAS5

M+G4(I!>S*;I55F@^QR6[1YSV/GQIXAW'_B8'K_ ,\D_P */^$U

M\0_]! _]^D_PH ]@ Z"EKQX>-/$.1_Q,#U_YY)_A7L"\J#[4 +1110 5Y?\

M1_\ D8;?_KU'_H35ZA7E_P 1_P#D8;?_ *]1_P"A-0!Q]%%% 'I_PX_Y%^?_

M *^F_P#05KL:X[X\B_/_U]-_Z"M=C0 4444 /\^I_

M.O8/&_\ R*-]_P _P#0UKQ^@ Y]3^==A\./^1AGY/\ QZM_Z$M77_ X_

MY&&?_KU;_P!"6@#U&BBB@ HHHH :Y*QLRC+ $@9QFN1TCQ5%K$9^W,^I (L:+>

MJCB-1G "@=^IR?>@"[H]U->:5!/\26GA_R/M44S^?NV^4 <8QUR1ZT 6)-)\[

M4/MI(YHT_218W$US)=W-W<2J$,LY7(49PH"@#

M&2>W>N?_ .%D:3_S[7O_ 'PO_P 51_PLC2?^?:]_[X7_ .*H [&BLS1-;M]>

MLWNK:.5$20QD2 Y ![$^M:= !1110 4444 %%%% !1110 4444 %%%% !11

M10 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %(WW

M3]*6D;[I^E '@)^\?J:2E/WC]324 */O#ZU[\OW1]*\!'WA]:]^7[H^E "T4

M44 %>7_$?_D8;?\ Z]1_Z$U>H5Y?\1_^1AM_^O4?^A-0!Q]%%% 'I_PX_P"1

M?G_Z^F_]!6NQKCOAQ_R+\_\ U]-_Z"M=C0 4444 K?^A+0!ZC1110 4444 'UKWY?NCZ4 +1110 5Y_\3?^89_VT_\ 9:] KS_XF_\ ,,_[:?\ LM '

MG]%%% 'I_P ./^1?G_Z^F_\ 05KL:X[X\ (OS_ /7TW_H*UV- !1110 50

MU/4_[-6#;:S7,D\GEI'$R YP3U8@=!ZU?K*UVREO[1(8].T^^&[)2]8A5.."

M/E;G\J ([KQ"EI=QV[V5R2U

MCB2.\DD=9(-OWMJ@$-GW/>NQH **** "BBB@!LDBQ1/(YPJ L3["N9L_%C7]

MFT]K'93/)(D=O#%=[F!8G'F_+\G SQNZ&NEEC6:%XFSM=2IQZ&N<3PO=!5D;

M4D-U L:6LHML!%0Y&X;OF)S@\CVQ0!L:5?27]HSS0B&>.1HI8U?< RG'!P,C

MOTJ]5+3+%K"U9))O.FDD:660+M#,QR

M@U&7][:9BB"+>R1LCER,B,?*_P!X=3VJ;3D1O$EQ+9WJ+'&5!8L0!]X@=^YJY5

M'5K=[K3WA2RM+S<1F&[;$9'O\K?RH I7OB+[!!$\NG71D>)II(E:,F)%QDD[

ML'KT4DUM(P=%=>C#(S7%W/A*^ELK6$Q6,WE>8T/U-

M)2G[Q^II* %'WA]:]^7[H^E> C[P^M>_+]T?2@!:*** "O+_ (C_ /(PV_\

MUZC_ -":O4*\O^(__(PV_P#UZC_T)J ./HHHH ]/^''_ "+\_P#U]-_Z"M=C

M7'?#C_D7Y_\ KZ;_ -!6NQH **** .?\;_\ (HWW_ /_ $-:\?KV#QO_ ,BC

M??\ /\ T-:\?H *Z_X\C#/_UZM_Z$M'UKWY?N

MCZ5X"/O#ZU[\OW1]* %HHHH *\_^)O\ S#/^VG_LM>@5Y_\ $W_F&?\ ;3_V

M6@#S^BBB@#T_X\B_/_ -?3?^@K78UQWPX_Y%^?_KZ;_P!!6NQH **** (Y

M[B&UA::XE2*)?O.[8 _&J7]OZ/\ ]!2S_P"_Z_XU0\;_ /(HWW_ /_0UKQ^@

M#V_^W]'_ .@I9_\ ?]?\:D@UC3;J98;>_MI96^ZB2@D_A7AE;_@G_D;K'_@?

M_H!H ]AHHHH **** .4N_'^F6=[/:R6UV7AD:-BJK@D'''-0_P#"R-)_Y];S

M_OE?_BJX#7?^1AU+_KZD_P#0C6?0!Z=_PLC2?^?6\_[Y7_XJNLM+E+RR@NHP

MP2:-9%#=0",\UX*>E>X:%_R+^G?]>T?_ *"* -"BBB@ HHKEO&/B.\T#[']D

M2%O.W[O-4GIC&,$>M &^VF6#WRWSV5NUVO"SF(%Q]&ZTRWT?3+2Z:ZM]/M8;

MAL[I8X55CGKD@9KSO_A8VL_\\+/_ +X;_P"*H_X6-K/_ #PL_P#OAO\ XJ@#

MU&BN6\'>([S7_MGVM(5\G9M\I2.N7G@'UKWY?NCZ

M5X"/O#ZU[\OW1]* %HHHH *\O^(__(PV_P#UZC_T)J]0KR_XC_\ (PV__7J/

M_0FH X^BBB@#T_X\B_/_U]-_Z"M=C7'?#C_D7Y_P#KZ;_T%:[&@ HHHH Y

M_P ;_P#(HWW_ #_ -#6O'Z]@\;_ /(HWW_ /_0UKQ^@ KK_ (\C#/_P!>

MK?\ H2UR%=?\./\ D89_^O5O_0EH ]1HHHH **** /#]=_Y&'4O^OJ3_ -"-

M9]:&N_\ (PZE_P!?4G_H1K/H 4?>'UKWY?NCZ5X"/O#ZU[\OW1]* %HHHH *

M\_\ B;_S#/\ MI_[+7H%>?\ Q-_YAG_;3_V6@#S^BBB@#T_X\ (OS_ /7T

MW_H*UV-<=\./^1?G_P"OIO\ T%:[&@ HHHH Y_QO_P BC??\ _\ 0UKQ^O8/

M&_\ R*-]_P _P#0UKQ^@ K?\$_\C=8_\#_] -8%;_@G_D;K'_@?_H!H ]AH

MHHH **** /#]=_Y&'4O^OJ3_ -"-9]:&N_\ (PZE_P!?4G_H1K/H #TKW#0O

M^1?T[_KVC_\ 017AYZ5[AH7_ "+^G?\ 7M'_ .@B@#0HHHH *\_^)O\ S#/^

MVG_LM>@5Y_\ $W_F&?\ ;3_V6@#S^BBB@#O_ (9==3_[9_\ LU>@UY]\,NNI

M_P#;/_V:O0: "BBB@#%\8?\ (EZY_P!>$_\ Z :^1Z^N/&'_ ")>N?\ 7A/_

M .@&OD>M('NY1\$O4*[3X3_\E+TG_MK_ .BFKBZ[3X3_ /)2])_[:_\ HIJN

M6QZ.)_@S]'^1]/4445@?(A1110 445#=745E;F>8L$! ^52Q))P .3R: )J

M1ONGZ5G_ -LV_P#S[WW_ (!R_P#Q-!UB @_Z/??^ O_ #Q:D_X1_6?^@3>_]^6H SQ]X?6O?E^Z/I7B0T#6NC6( H'V>^Z?\^.H)4E;20\@X(^[ZT :=>7_$?_D8;?\ Z]1_Z$U=_P#VS;_\^]]_X!R__$UP

MGC2UO=7UB&XL=/O9(U@"$_9W7G<3W'O0!Q=%:/\ PC^L_P#0)O?^_+4?\(_K

M/_0)O?\ ORU '??#C_D7Y_\ KZ;_ -!6NQKB_!;RZ/H\MO?65]'*TY\(_K/_0)O?\ ORU &=77_#C_ )&&?_KU;_T):P?^

M$?UG_H$WO_?EJZ/P7:7ND:Q-<7VGWL<30% ?L[MSN![#VH ],HK._MFW_P"?

M>^_\ Y?_ (FFR:[:11M))%>HBC+,UI( !Z_=H TZ*SO[9M_^?>^_\ Y/_B:/

M[9M_^?>^_P# .7_XF@#R#7?^1AU+_KZD_P#0C6?6[JNC:K=:Q>W$.EWK12SN

MZ'R&&022.U4_^$?UG_H$WO\ WY:@#/'WA]:]^7[H^E>)#0-9R/\ B57O7_GB

MU>NC6( H'V>^Z?\ /G)_\30!HT5G?VS;_P#/O??^ .H

M)4E;20\@X(^[ZT :=>?_ !-_YAG_ &T_]EKK_P"V;?\ Y][[_P Y?\ XFN0

M\_]^6H_X1_6

M?^@3>_\ ?EJ .^^''_(OS_\ 7TW_ *"M=C7%^"WET?1Y;>^LKZ.5IRX'V5VX

MP!V'L:Z/^V;?_GWOO_ .7_XF@#1HK,.NV@E6(Q7@D8%@OV23) QD_=]Q^=._

MMFW_ .?>^_\ .7_ .)H H>-_P#D4;[_ (!_Z&M>/UZQXHNSJ7AVZM+6TOGF

MDV[5^R2#.&!ZD>@KSC_A']9_Z!-[_P!^6H SJW_!/_(W6/\ P/\ ] -4?^$?

MUG_H$WO_ 'Y:M?POINHZ;XBM;NZTV]2&/=N;[.QQE2!P!ZF@#UBBL[^V;?\

MY][[_P Y?\ XFFR:[:11M))%>HBC+,UI( !Z_=H TZ*SO[9M_\ GWOO_ .3

M_P")H_MFW_Y][[_P#E_^)H \@UW_ )&'4O\ KZD_]"-9];NJZ-JMUK%[<0Z7

M>M%+.[H?(89!)([53_X1_6?^@3>_]^6H SCTKW#0O^1?T[_KVC_]!%>0?\(_

MK./^03>_]^6KU+2M2CM='LK>:VOEDB@1''V20X(4 ]J -VBL[^V;?_GWOO\

MP#E_^)IJZ[:.SJD5XS(=K 6DGRG&^_\ Y?_ (F@#1HK,;7;1&17BO%9SM4&TD^8

MXS@?+Z T[^V;?_GWOO\ P#E_^)H K>,/^1+US_KPG_\ 0#7R/7U=XCO1J'AC

M5;.VM+YY[BTEBC7[)(,LRD 9(]:^>/\ A7?B[_H WG_?%:0:1[65U:?]\5TWP^\)>(="\;Z?J6HZ->

M0VL/F;W$1;&48#@3CFI[36-0*WEM>:8HU*VC600VTVY)5;(!5V"]P>5"@'4;]I).3Q\OY5U-K*;BTAF)B)D0-F

M)]R'(_A/&1[T 35#;6R6L31Q[MI=G.3W9BQ_4U-10 445DPZO.VMWEE<67D0

M00B5)FD!,@R03@=!QW.?84 :U%& 26[SSX$Q)(YV@[5XZ\GVH VJ*Q-%U+5K

MR_O;74K*RA%L$'F6MRTH+$9*G1W)W>9&C(.>,,03_

M .@BIJ** "BLG7+_ %+3[?S["RMYXXT:2=[BX\H*JCH,*Q+'\!QUJO=:OJLU

MTEOHVFP3,(5FF>\G,*IN^ZHVJQ+IV>7C@!C][H* .

MAJ*ZMTN[2:VDSLE0HV#S@C%2T4 (!@ >E+14-U,UO:33)'YC1H6";@N+I[W1[J[6UM+F6.588/L%UYL4SM@ !RJXP3SQQ[U?LM6U-;TV

M.K:=#%G>@#

M2J&VMDM8FCCW;2[.VU>QL8;?S5FE\N:7=@195F7

MMR3MZ=ASZ4 :U%W=@\AN#Y[*IPSK'MP1P2,L"0*ORZM

M4 ,P ( 49..>2<>P- &O16!IVIZY)KAT_4=/T^.,0&5

MI+6[>4ISA00T:]?F[_PFM^@"%K9&O([D[O,C1D'/&&()_P#014U%% !16?K5

M_7Y@08 SDD]OH"?:JE]JU_\ Z'!I=C#<7=Q%YS>?,8XH

MT&,Y8*QR20 /7I0!MT5SS^(;U-%OKC^R]VH6+%)[=9@$!"AMPJ1 (=[#ODCJ* .KJ*ZMTN[2:VDSLE0H

MV#S@C%2 Y .,>U+0 @& !Z4M%1W#R1V\CPQ&:55)2,,!N/89/2@"2BN=3Q!?

MQ6-Y]KTZ(ZA;RI"D%K.721G VC>RKCKSQP.>:FLM6U-;TV.K:=#%*KR#03?R6-M;S"Z>W<7-R5BA )^9W53C

MIC@$9.,]ZV]%OY=3TF"\G@$$D@.45BPX)&02 2#U&0.#0!?J&&V2"6>1-VZ=

M][Y/?:%X_ "IJ* "BBNDPMH]N[!Y#W!'!(RP) K0?5KA=>M[$61

M^S30O(MR9!\QA5Z]^IQ^- &M17,^'?$UUK6HS6\MI;(B(6)@G:1H6R!LE!

M0!7P>@)Z'VKIJ (9K9)Y8)'W;H'WI@]]I7G\":FHHH **K7UW]CM6D"&20_+

M'&.KL>@_^OVZUBC7]2N[#3#I^FPR7UY!Y[I-(@@Y!W(0?UJ[10!R]MX-33

M;'R],OYX;J.ZDN8IYV>< OG*LK-DK@^HR1GK3[72/$5O=7L\NK65Q/=1*JSF

MT91!M/"B/>=RG+$DL#GU[=+10!R=KX8UJSM+41:Y:?:[=&A$IT\E&B.#@IYG

MW@1US^%='I]DNG:?!9H[.L*! S8R??BK-% !1110 5@#1=4?Q#-?3ZG:R64L

M1A:U%D0WE\D#?YG7)Z[?PK?HH Y.;PYKZPV]O!K=O+96DB/%;2VI5Y ARJ22

MACQP.0O85?ATG6%\1OJNWGT%;M% %33;$:

M?9B$R&61F,DLI&"[LTC99S(]T]J96GRP?)7P7EYQP>OT

MJ:B@#FT\,W4T=U-?ZDDFHS&,I<6UMY2QF,DH=A9L\DYR>1QQ20:1XBCU9;ZZ

MU:RNSY+0*HM&A6'/.\#>V\Y"@@D<="._2T4 '4@]W%

M.ER+F0+=S;9&"D?=W[1VZ#MCO71T4 ^&=8>UN+#3]=BM].F9F\F2TWR ,

M;-<2F1W(QQT51[ #\SWJY110 4444 9VMV5YJ.E36EE>16

MDDH*-)+!YHVD$'"[EY]\UGG0M5$%G-%J\":G;QF%I_L9,4D9(X,>_.1@8.[U

M]:Z&B@#E4T#7_P"S=2LWU>S::]X="L$;L=N1G'I4]% '-6GAJ^31WL;S5(I95D6:"X@M3&R

M2 YW-EVWY/7IQQ1!I'B*/5EOKK5K*[/DM JBT:%8>O!!!'O6[HVFG2=.6V:59'+M(

M[)'Y:;F))VKD[1D],FM"B@ HHHH *PKW1+^_U)6GU.)M-69)UMOLO[Q67! $

MF[ID9^[G&1FMVB@#E;[PSK#VMQ8:?KL5OITS,WDR6F^0!CED$F\84DD?=R >

MM3W.C:W>ZE:7C:G9VL4411[:.U:0C< 'Q+O7TX.WCT-='10!SVC>';K3[V&>

M[O[>X6V@,%N(;3R6"$C[YW'=T'0 9R:Z&BB@ HHHH SM6T.QUM(EO5G/DL6C

M,-Q)"5)&.J,#TK)MO"4NE:?81:/J;6]U:1&'S;E&G61202"IVTF1M#L5N[YCM17D

M5 F>K'<1G'IWH*@KR2*,?C/3O[&U'4;N.>T&G2F&YAE +JXQ@#:2#G(Q@]Z+

M?Q?$=02QOM,O["XEMS<0)*BN9E'4+L+?,/[O6L.7PQ>W7@B\TRWL9[?4#,MT

M9;V6-C=3!@Q)*,<9QCMCBKC6NMZKXETW5[K2'LX=+MY2(6FB=YY7&-JD' Q

MU)'6JLCIY*6OSZ^6GWLT--\9Z=?Z1J6IRPW5E!ITK1SBZCVN"H!^Z,GOTZU+

M:>)?-MEO+[3;G3+%D#K)M.ETJ6T?4;MKR

MWD>XCQU4A"58D$[3SC%7].L-;LM9M[ZWTC48+6*W*7%K-J2SF=SC&T-(0-N,

MYR,],460Y4J6MG^/EZ_YG1ZUXA32)]/MUL[B\GOY#'"D!09(727%MI5WX?U#^VC 9)H5$G-+

M%H]5VW%M&3GRW;S%W GG[S8Z58T/1?%.@:K;ZI=VYU1IK,V\T2W">;!ARR L

MY ? ."IPVVJ32>'[A]8U

M*9Y3-%J(BAB#GA6V2 MMR73?"NCO"EU96.];QBP PT9&0#R?

MF/&*+('3PZDM=/7R_P ]MCH/%'BW3O"FFPWMZ))5FD$<E*) -\

M8U%D"

MHT.6SEKWOZ6.QM?%VGWGB^Y\-P+*UU;1>9)( /+'3*YSG/([5OUP^@>%+W1_

M%%E>.@DC&G.MU_M7<4F@'4T^HYWDCMY'BB,LBJ2D88#<>PR>!0",33?%,=

M[JJZ;Z?<26_VF);H*-\8.#]UC@CT.#5'_A/K+R$OOL%Z-)>X^SKJ.U?*

M)SC=C=NVYXSC%0:!9:M/JMUJ&NZ1<1:A=QM#YHFB:&VB[(@#%CGJ3CD^E9(\

M/^(Y?!L'A"33414G"/J'G(8_)5]VX+G=N. ,8JK([%3I3SWQCWJKJ/C";2%@>_T"_A2>98(SYL#%F;

MH !)GWJH\&K_ /"P8-471+@V45FUF9//AR27!WXWYVX_'VK0.F7U_P",3J-[

M$%L=/BVV$>X$R2,/FD/I@?*,^]+0GEIIIO:W?J7;_P 16%EX=N-<23[59PH6

M)MR&W8.#CG'6LB?Q]8Z>+@:K8WEA)%:BZ1) CF5"VT;2C$9R0,''6K/B:TO]

M>\#ZA:06+PWEQ$52WED3._?TZ[&YH_B'4FGU$:[IE2Z3XPL]9T"XUBVLK_RH9&C\GR"TK$8Z*N3SFN.L?#][XF%M)I'V

MK2/#AB5FM[V7[2MPR-\H";R548Y^89XXKI/#6G:YH-EJSWD*7;2WCRPP6RI&

MS@D?-EGP!['ICO0TBZE.DD^^FG]7_/0MV7B]=3T2SU*PTC4;C[4[HL"HH9-I

M()$)O$@AN#;0JQDBVCS%*G:5QG&0?>N7TVW\7Z5X1BT:TT

M*:*X::3S;D7,!\M&Y'&,]:S8/!>JP:XFFQK$GA:5TO9H@1E9E',8

M&?NE@#TQ6=:?#S4;N.TMM2M4B2.TN4$HD5C#*TN^-A@^G/'THLBXTL/K=_\

M#:_B=SKWB[3_ ]J6F6%RLLEQJ$HCC6( [)=0M;34M8

MBBDUG^T+^*6'Q? 9[ZTN=-U"WOK2-96M/*$LDB'@,FPL&&>.O'>LB\\/W@\/Z-_9

M&E/;S:1>K.MGUUA_%%[XDGTF2-5LUM+>R$L1ED^

M;+[&?4KC3;V.33;V%D7R;ED^QK6\-:;JFAZI=F'1[F+2[EE_=37$,DRR'[TA

M;=DKCL68^E%D5*E22E9][:FYJGB/^S]9@TJ#3;J]NIH&G"PM&H"JGI4VO\ A>;7/%]M:?=+%*SY./NL

MI4,O)YZYR*$D%.%)Q3W?_#^?^1TTWC;[)IPOKG0=7BMXXU>YDDA""')QT9@6

MQU.W/%6M8\5QZ.))I-+OYK*%$DFNXT41H&/&-Q!;'?:#BN3BTWQ?F1-YL@ANHC)/SE(G9F&0O&3_ !$?C6QXA@UK5[^WLI=#N'T*-5EE2&XA

M#SN,$(V7&$!ZXZX]*+('3IJ26GW]/\RQ=>/K.W%_/'I][/8Z?*L5S=1A J$X

MZ*6#'&>PJWJ?C/3-)U[2])N1*)-27,,N!L'H&R#[SQ'K-J]Y'&432WB:Y0@>7<

M[@591UZCK19#]G035WIZ^7]?Y&YK_B_3_#VI:;87*RR7&H2B.-8@#MR0-S9(

MXR:3PUXOT[Q2]_'9K+'+93&*6.4 '_>&">#@_E7(IX4\2ZA:VNI:Q%%)K/\

M:%N75)%"Q6\1ZCG&2>3CUJM%X+\2Z79PWFC106^J3S3V]X&=2&@D2W-[W>^G_#'WB@?>"7**0Q(ZYR>]==2?D

GRAPHIC

4

x19032818431503.jpg

GRAPHIC

begin 644 x19032818431503.jpg

M_]C_X 02D9)1@ ! 0$ 8 !@ #_VP!# @&!@7J#A(6&AXB)BI*3E)66EYB9FJ*CI*6FIZBIJK*SM+6VM[BYNL+#Q,7&

MQ\C)RM+3U-76U]C9VN'BX^3EYN?HZ>KQ\O/T]?;W^/GZ_\0 'P$ P$! 0$!

M 0$! 0 $" P0%!@'EZ@H.$

MA8:'B(F*DI.4E9:7F)F:HJ.DI::GJ*FJLK.TM;:WN+FZPL/$Q;GZ.GJ\O/T]?;W^/GZ_]H # ,! (1 Q$ /P#W^BBB@ HH

MHH **** "BBJEYJ=AIVS[;>V]MO^[YT@7/TS0-)O1%NBJ]Q?V=K;+0W4$EJ

M29ED!3 Z\]*99ZKI^HLRV5];7#(,L(I0Q _"@.5]BY14$5[:S3S017,3RP8\

MU%XH"S):*,C.*J7FJ:?IQ07M[;VQ?.T

M2R!=V.N,T DWHBW134=9$5T8,C#*L#D$5674K1]4?35ES=I$)6CVGA2< YZ4

M!9LMT44C,J*68A5 R23P!0(6BL^VUS2;R=8+74[2:5L[4CF5B?H :T*!M-;A

M1156XU"UM;JUMII=LUTQ6%=I.X@9/TXH!)O8M45%<3QVMM+<3-MBB4N[8S@#

MDTEI=0WUG#=6S[X9D#HV",@].M 6=KDU%%% @HHJA-K6G6][+:3721RPQ":3

M?PJ*3@$MT'YT#2;V+]%5%U33WMH[E;VW,$C;$D$HVLW3 /DZ[X3T^ZF66W@@E5'?[IFP/PSUQ5G0[6SN]7\31&"WF

MTUKE,(5RAD"_/UXSG%=*VDZ:]FMFUA;-:H4-G7/3IUIW-7637]=[W. LI;*#X2W"W,3/ 99$"1.%()EPO/8 XK1T>

M.XL_&5K'JDD-U=RV!6"6VP%C08R&4#N+4O._X_P!?,\^>.?3O$.O>

M(K0,YM;OR[N('_60%!DX]5/-5/#&LZ@UKINE61N8[.:]12UMT,Q2")3,*K/HFE26\=N^FVC0Q9\N,PKM3/7 QQ1<

M?UF+5I+M^1PNER:GJ7BC2I;_ %%XYFMYU5X&B8,JL!V!&3W'KTQ70:U9C^VV

MU&RO;$WT-H4FL[L J\6_."*W7TC39(X(WL+5D@_U*F)2(_\ =XX_"B[T

MC3;^19+RPMKAU& TL2L0/3)%%R763DGL6M]=:U%&C7;Z+;MTX4LX!./;.:]"N-#TFZ2<1CE/[OT]J+HKV]-;1.'N=6\16[M;P

MWR(9K8,CZC);JP?(Y0(>C=!D'G%;.DZA+=Z7K-O7;1)LE).0/FR=V.N,#-6CK^NII0O

MO[2FD:XU1K)46*("),GD9 RW&!DXYKN[?0M(M)UGM]+LXI4^ZZ0*I'T(%3'3

M;$VKVIL[?[/(Q9XO+&UB>22.A-%S1XB#>JN<5+KVJVN=U/Q)J\7B2.+RIKV:QN"8(Y50R#=&I+HFE

M+;/;+IMF('8,T8A7:2.A(QUHM]$TJTE66VTVTAD4Y#QPJI!Z=0*+H(XBG'7E

M."_M.^U73]?1O$P>WM;0,CK#&HEW(2W#Z/H\>H'3[==

M)2XWHJ%I6Z8!8$8'6NND\/:+,[/)I-B[,2S%K=223U)XJ6?2--N88H9]/M98

MH1B-'A4A!Z 8XHN)UX-62_+L>@)XKTMM.L62W1K. I;D&%3&,1D

M="OI^%-_LO3]DZ?8;;9)4*N&PF+KTOBA)[D6\J7T9$K+D*L8!7(XR.

MM=O]EMQW-=?87(E^

M(32PY6.[TF.9T/KN^4GWP<5T5QI6G7:1)O/-%RYUXS3=M;&I1112.0**** "BBB@ HHHH *

M*** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HH

MHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB

M@ HHHH **** "BBB@ HHHH **** "BL?4O$=EIY,8/G3#^!#T^IKF+OQ1J-R

M2(W6!/1!S^= '?9 ZFHWNK>/&^>)A4RFHO@E?\ ^E:*X3PK\5=!\1L

MEO,YT^^;@13L-K'_ &6Z'\*=9,DAT^W;"+_ *UAW/I7

M+T %%%% !7#_ !'_ ./>P_WG_I7<5PWQ'_X][#_>?^E5''V/JOZBO*J*329E6HPK1Y9H^SXI8Y

MHDEB=7C=0RLIR"#T(I]>%?"/X@/:7,7AK5)<2l>WH:]UK%J

MS/E\3AY4)\D@HHHI& 4444 %%%% !1110 4444 %%%% !1110 4444 %%%%

M!1110 4444 %%-$B%]@=2P[ \T*ZL2%8$CJ >E #J*:716"EE#'H">32AU()

M# XX//2@!:S]9O\ ^SM,EG!_>$;4_P!XUH5QOC*Z+74%J#\J+O(]S_G]: .9

M+%F+,26)R2>])110 5?TS2+K5)2L*@(OWI&Z"H]-L7U&_CMDXW'+-Z#N:](M

M;:*SMT@A4*B# % &39^%=/MU!E5IW[ES@?D*GN_#.AW\2QW>E6DRK]W?$"1^

M-:M% TVG='GVM_![POJD;-:0R:=.1P\#$KGW4_TQ7BOB_P "ZOX.N0+Q!-:N

M<1W40.QO8^A]J^JZJ:GIEIK&FSV%]"LMO,I5U/\ ,>AJE)H[L/F%6D[2=T?'

M%%;OC#PW-X4\27.F2DM&IWPR$??C/0_T^HK"K8^DC)3BI1V8JLR,&4D,IR".

MQKZG^'GB0^)_"%K=RMFZB_<7'NZ]_P 1@_C7RO7K'P+U;JCWJBHKFXBM+:2XGLCYL["BL#POKHUC3[J22]L[LVLQ

MB:ZM.(I!M#;@,G'#8(R>E4W\1:A*^J&U6%HH[:.:T"1-+)M8L"Y13E^F0HP<

M>YH ZNBN4T;Q4^H7]G8W,MM!PCMK37[T:+=:'J-Y.UR

M7>VM0+JW+;F!>0,>?[^

M=WWN?O>]=Z !T %&!Z#GK0!YW>RQCQM++<3 m>E $=K-]HM(9O+:/S$#[&'*Y&;ZZ,:Y=_P"_

M0!G4444 =?X,M@(;BZ(&2PC!],#F!TF11U$QS^0KH: "BBB@ HH

MHH \A^.^E(^E:9JR@>9%,8&XZJP)'Y%?UKPNOHCXWRK'X'B1@,R7B*OY,?Z5

M\[UM#8^ERQMX=7\PKK/AG=-:?$/1W4XWRF(^X8$?UKDZZ+P&C/X]T,*,D7D9

M_ &F]CKKJ]*2?9GU5=6EM?6TEM=P13P2##Q2H&5A[@\&L>W\):;IL5\NC+_9

M,EXZN\ME%$K+@ 8 *D8X[@]36]16!\>9EIHL5I:K;_:)YE9V>X,VUCQN)H1"7MH43:,DY&!UY_05N44 82>%;**

M[M)H9KB..W"YA#*5F926#.2-Q;,

M+(R6D5VHYB.UOH?_ *_\Z .+HHHH Z/PC?""^DM7;"S#*Y_O"NVKRA':-U="

M593D$=C7>:'K\6HQ+#,P2Z P0> _N* -NBBB@ HHKA/'_P 1['PK9R6EI(EQ

MJ\BD)&IR(O\ :?\ P[TTKFE*E*K+E@M3S_XW^(8[[6K718'RMB"\V.GF,!@?

M@/YUY14MQ<37=S+(_B7>:)I/VJ+3H97WA?FL^N=\E:9;Z-I5KIUHNV"WC$:#UQW/N>M88KVT^6/PH****D\\**** "B

MBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH **** "BBB@ HHHH ***

M* "LS5M$M]5CRWR3@?+(!^A]16G10!YIJ&DWFFOB>,[.TB\J:HUZPRJZE74,

MIZ@C(-8UWX7TZZ)9$:!CWC/'Y4 2C5C)[)H^=Z*]@L_@+

M?,P^W:W;QKW\B(N?UQ79Z)\'_"^DLLMQ%+J$R\YN&^3/^Z./SS6KFCWZF98>

M*T=SPOPWX-UOQ5,HKZ2QMKJ$684OYX49W;L8P3_=-.SMYG2UM)(TDWSL%"AL8R>G>I[?4+.[BBEM[J&6.5#)

M&R."&4=2/;D4C,LT5F3^(=&M9+:.XU2SB>Y"F!7F4&0-TQZYJ+5/$NF::\]L

MU[;-J$G7H* -BBLV'Q#H]Q97%Y%J=H]M;$K/*LH*QD=0Q[43

M>(-'M].AU";4[5+.8XBG:4!'/H#WZ4 :5%4-6U6/2=,DOFMY[A4&0ENFYC_0

M#W) JOJ>MR6%M#/#I=W>(Z&5_)V 1( "22S =^@R?:@#7HK)C\06LNO)I*QR

M[Y+9;A)B!L8'.%'.=V 3TZ"F1^([:6?4XH[>YD^P;=QCCW^;G(^0#DX*D'Z4

M ;-%84WB5(]%L=0CL+B62]($5L&C5@)9,

M_(^,J02",@D'D=02#0!=HHK$OO$]I87LEK)#,SIC)4#'(SZT ;=%9Z:O#)IT

M%Z(Y/+FD6-5P,@LVT9_&FKXAT9[R:S75+0W,"EY8A,NY%'4D=L4 :5%5;G4K

M*RC>2YNX842/S69W 3^]]*@EU[2(--CU*74K5+*3[D[2@(WT/X4 :-%8Q\5

M:+_:5E8#4;/H:F@\1:+=?:O(U6SD^R?\ 'QMF4^5V

M^;TZ4 :=%4K75]-OK1KNUOK>:W4[3*D@*@^F:NT %%%% !1110 4444 %%%%

M !1110 4444 %%%% !1110!QWQ'\)7OC'0+?3[&>WADCN5F+3E@" K#' //S

M"L[X<> =2\&P:M'?75K,;Q8Q'Y!8[=H;.AR":5X

MDD\+KIF=N2#2

MSZ+JV=3LHH]/DT^_W,TTLC"569 N"NTAAD=#R-

MK);>7$97A#&)F."R?,HPPP1Z=*BD\/:E'H%G::?:VEM=QS-*9!J,S>2QS\RN

MR$R$YY#C%=?10!E:[;ZEEK+!Z5U5% '-W^A7]S//>P26T-[Y,'V?DE

M8Y$+[@3C.TA\=,XSQ4L&CWFE_:Y+#[//(]M#%&MQ(R!F4N69V"GKNSP#S6_1

M0!QO]@ZY+X=LK*[M=(GDM7P]H\\AMYTQP6/EYR"E=310!C

M1:1/'HMG9&2/S()XY&89P0LFXX_"H8_#[(;'B ""[GGEVC&X2"0>G7YQG/I6

M_10!QUUX2O;G1Y89IH;BZ6:/R 9I(5,49^16=/F4\DDCOZU?TWP^;>TTI'M;

M>$VEP\[QK/):Z*B@#F$T'4+=+>.!K4J?M44Q+,I2.63>&3

M Y8J9\,:M?67V:_33(EM[,V7!4;1A!\HW=>O'/9T43>2l>

GRAPHIC

5

x19032818431504.jpg

GRAPHIC

begin 644 x19032818431504.jpg

M_]C_X 02D9)1@ ! 0$ 8 !@ #_VP!# @&!@7J#A(6&AXB)BI*3E)66EYB9FJ*CI*6FIZBIJK*SM+6VM[BYNL+#Q,7&

MQ\C)RM+3U-76U]C9VN'BX^3EYN?HZ>KQ\O/T]?;W^/GZ_\0 'P$ P$! 0$!

M 0$! 0 $" P0%!@'EZ@H.$

MA8:'B(F*DI.4E9:7F)F:HJ.DI::GJ*FJLK.TM;:WN+FZPL/$Q;GZ.GJ\O/T]?;W^/GZ_]H # ,! (1 Q$ /P#W^BBB@ HH

MHH **** "BBB@ HHHH **** "BJXO[,WYL1=P&\">8;?S!Y@7INV]<>].M[R

MVNS*+:XAF,+F.41N&V..JG'0^QH'9DU%%(S*BEF(55&22< "@0M%9MEXAT74

MKC[/8:QI]U-@MYGM0"3>Q?HI'8(C.QPJC)-5=,U.SUC3H=0L)O.M9AF.3:5R,XZ$ ]10

M%G:Y;HHJGJFJV6C6+7M_/Y-NK*I;:6)). "223V% )-NR+E%9=SXET&SN6

MMKK6].M[A,CS,L"N[

M( XY-%BE3F]D;U%%%! 45EWWB/1].AN9;G4( +5TCG"'S&B9SA0RKDC/N*GT

MO5K+6K%;W3Y_.MV9D#[&7E20>" >H-!3A)+FMH7:*Y^+QOX=FU;^RX]1#7IF

M, B\F3YG!((!VX(!!R0_OK?3+">^NW*6\"&21PA;:HZ