- 1生成模型 | 数字人类的三维重建(3D reconstruction)调研及总结【20240222更新版】_drive smpl human body

- 2空间转换案例-3D导航_3d导航栏案例

- 3Python+unittest+requests+HTMLTestRunner 完整的接口自动化测试框架

- 4Jetpack Compose有多好用 阿里大神都推荐_jetcompose好处

- 5Devops项目实战-k8s_from jenkins/jenkins:2.392-jdk11

- 6kali linux 2016 安装和使用指南_kali2016 有浏览器

- 7鸿蒙开发之获取应用信息(versionCode、versionName、packageName等)_鸿蒙 bundleinfo.appinfo icon

- 8SpringBoot配置文件application.properties参数详解_applicationg.propreties${database_host:localhost}

- 9gradle镜像配置:使用阿里云仓库服务的代理仓库地址代替jcenter()、mavenCentral()及google()_init.gradle 默认替换掉 mavencentral()、jcenter()、google(

- 10怎样在一台电脑里访问其他电脑里的虚拟机_访问其他地脑上的虚机

全球翻译公司25强排行榜 _commonsenseadvisory数据

赞

踩

出处:Common Sense Advisory 作者:Renato S. Beninatto, Donald A. DePalma 【编辑录入:giltworld】

- Source:http://commonsenseadvisory.com/members/res_cgi.php/080528_QT_2008_top_25_lsps.php

- 翻译:颜玉祚(北京大学计算机辅助翻译专业)

2007年全球翻译公司25强排行榜

从2005年开始,Common Sense Advisory公司每年发布一次全球20强语言服务提供商(LSPs)的排名。由于过去一年中翻译、本地化和国际化市场的稳定增长,我们将今年的排行榜从20家增加到25家。

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

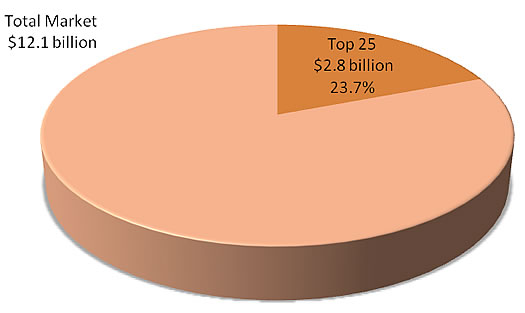

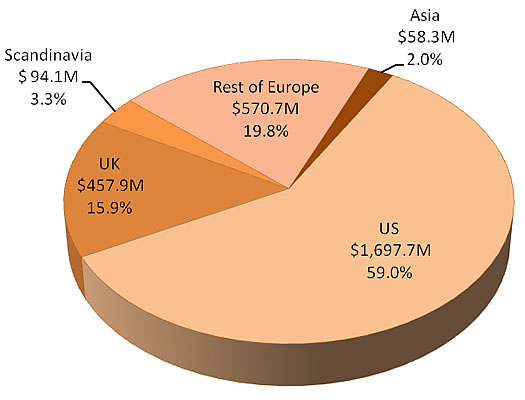

Ranking of Top 25 Translation Companies

| Since 2005, Common Sense Advisory has published an annual list of the 20 largest language service providers (LSPs). Solid growth in the translation, localization, and internationalization space led us to expand our list this year to the Top 25. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||